Five things you need to know about the most trusted savings account for persons with disabilities

Maybe you’ve heard of Florida’s ABLE savings program, ABLE United? But do you really know how it works, and why it’s the best option to work alongside other government benefits and savings vehicles?

That’s exactly what we’re here to tell you. Let’s set the record straight with facts that dispel some of the most common misconceptions people have about ABLE savings and investment accounts.

- Having an ABLE United account DOES NOT affect other benefits.

Whether you or your loved one currently receives any number of federal or state benefits — including, but not limited to: SSI, SSDI, Medicaid, SNAP, TANF, HUD Assistance and Section 8 — this does not prevent you from opening a tax-advantaged ABLE United savings account. The account will not affect other disability benefits, and this is one of the main reasons ABLE accounts were created.

In fact, these programs work well together, including alongside Supplemental Security Income (SSI) — you can save up to $100,000 with ABLE United before your savings counts against the SSI $2,000 asset limit. And, housing expenses don’t impact SSI if they are paid directly from the ABLE United Account to a third party, or withdrawn and paid in the same month. - ABLE United accounts are not subject to Florida Medicaid Payback.

On June 7, 2019, the Florida Senate signed House Bill 6047 assuring all ABLE United beneficiaries and their families that there will not be a Medicaid claim filed on an ABLE United account when a beneficiary passes away. ABLE United accounts can be used to pay for funeral and burial expenses, as well as legal fees and other Qualified Disability Expenses, and any additional funds will be paid directly to the individual’s estate. In an already emotional and stressful time, ABLE United will be there to assist you. - You CAN access your ABLE United funds whenever, wherever.

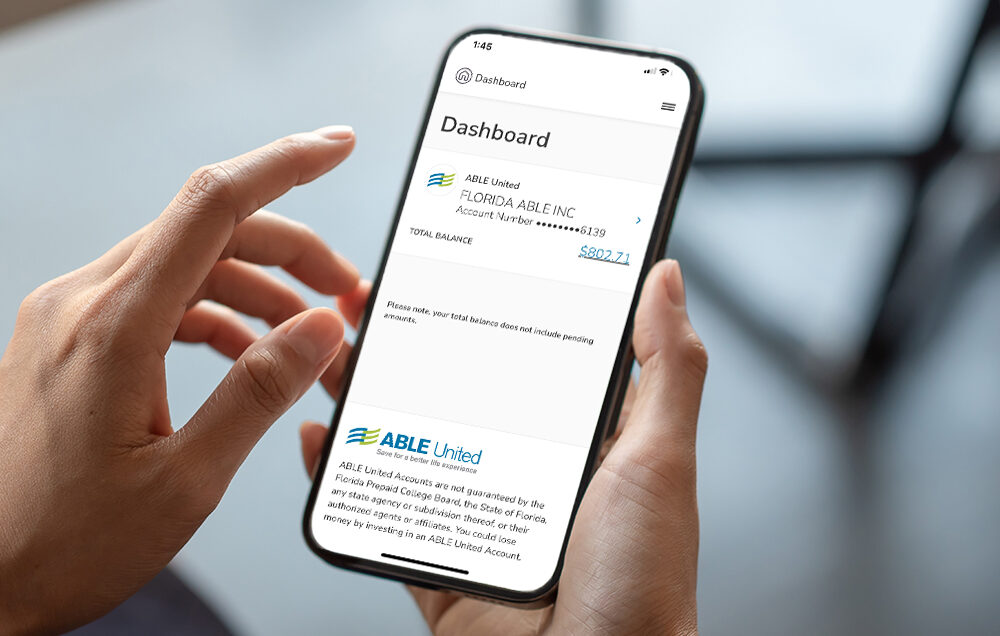

Plainly stated, you can request a withdrawal from your ABLE United account for any reason. There is no preapproval process. It’s easy to use your ABLE United account. And, because you may not always be able to anticipate when you’ll need access to your money, we’ve made it easy to use ABLE United funds with an ABLE Visa ® Prepaid Card. You can use your prepaid card everywhere Visa is accepted, and manage expenses in an online portal. - You can open an ABLE United savings account at ANY age.

There is no age limit when it comes to opening an account; the requirements for opening an ABLE United account are that the beneficiary must be a Florida resident when applying, and must have a qualifying disability with onset prior to age 26. We’ve put together an easy tool to help you check your eligibility for an ABLE United account, and a helpful list of eligibility requirements. - An ABLE United account DOES NOT replace a Special Needs Trust (SNT).

We understand how important it is to prepare for whatever life has in store, which is why ABLE United is designed to help persons with disabilities maximize the ways they can save and grow their safety net. While an SNT can be used to fund an ABLE account, it can also include non-cash assets and requires an attorney to set up — at extra costs to you. Alternatively, ABLE accounts provide flexibility, are easy to open and manage, and allow your earnings to grow tax-free.

ABLE United’s name was derived from the Achieving a Better Life Experience (ABLE) act and created by people who care, for people who deserve an account created with their needs in mind. Whether you’re just beginning to devise a savings strategy to work in conjunction with other government benefits or are seeking to expand your current plan and take advantage of tax-free savings, ABLE United is your partner. ABLE United is managed by the Florida Prepaid College Board, trusted by Floridians for more than 30 years.

“ABLE United makes everything so simple with transferring money in and out of my account when needed. It gives me peace of mind to know if I have an emergency that money is there and I don’t have to wait for my next check from Social Security to cover that expense. An ABLE account gives me the ability to budget and plan for future expenses which is something I would have not been able to do before having one.

I knew I wanted to save for “big ticket” items that would otherwise be out of my reach. I need a wheelchair accessible van to get myself to and from work independently.”

— SAMANTHA LEBRON, ABLE United Account holder

Open your ABLE United savings account online today, or call 1-888-524-2253 with any questions you may have.

Back to Blog

Back to Blog