Overview

An ABLE United account gives Florida families a better way to save and care for their loved ones with disabilities, without losing any benefits.

Watch Overview

An ABLE United account gives Florida families a better way to save and care for their loved ones with disabilities, without losing any benefits.

Watch OverviewMust be a Florida resident at the time of application and have a qualifying disability with onset prior to age 26. Learn about the age change coming soon.

Generally, funds in (or withdrawn from) an ABLE United account are disregarded when determining Supplemental Security Income (SSI) or Medicaid eligibility.

If the money in an ABLE United account is spent on one of the following Qualified Disability Expenses, as defined by federal law, the earnings on the money withdrawn are tax-free.

In general, Qualified Disability Expenses include, but are not limited to, the following types of expenses: education, housing, transportation, employment training and support, assistive technology and related services, health, prevention and wellness, financial management and administrative services, legal fees, funeral and burial, and basic living expenses.

Open an account: It’s free and easy and takes about 15 minutes. The individual with a disability owns the account, but an authorized person may open and oversee the account.

Contribute: Get started saving today with as little as $25. Save up to $19,000 per year – individually or with the help of family and friends. Now, with ABLE to Work the beneficiary can save even more than $19,000 if working and not saving for retirement.

Choose investments: Choose from three predesigned portfolios or five individuals funds, including an FDIC-insured savings option, to build a portfolio that meets your savings goals.

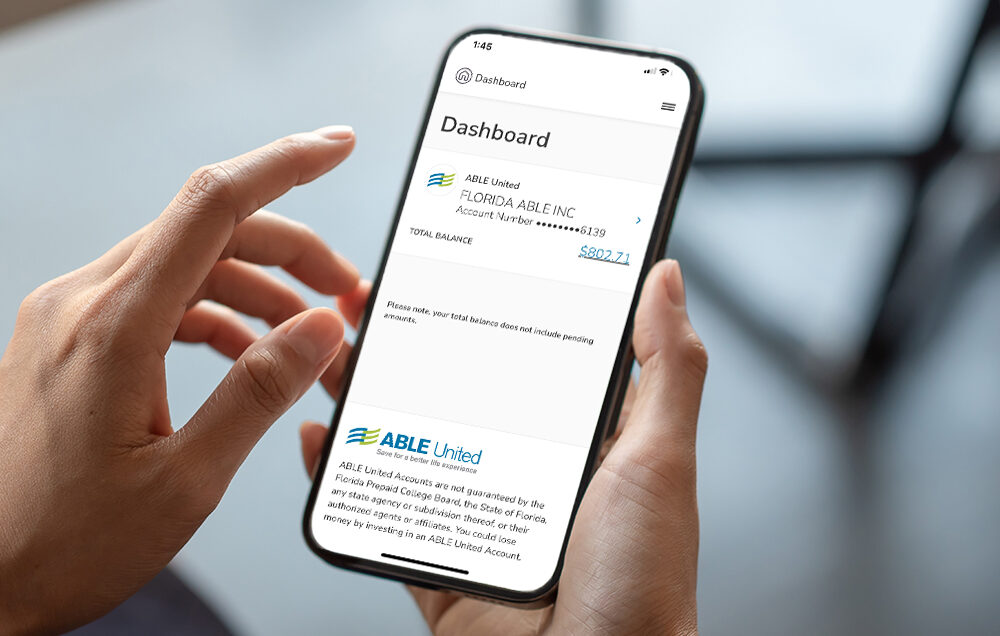

Manage: Take your account with you wherever you go. Find all the same easy-to-use account features in our new mobile app! Manage your savings and access your account without interrupting your busy schedule.

Withdraw: Easily access funds online by requesting an electronic transfer to: a linked bank account or reloadable ABLE Visa® Prepaid Card; or request a paper check from customer service.

Choose a predesigned portfolio or build from the individual fund options.

| Predesigned Portfolios: | Fund Options: |

|---|---|

| FDIC Savings Fund (BNY Mellon) | |

| Conservative Portfolio | Money Market (Florida PRIME) |

| Moderate Portfolio | U.S. Bond Fund (Vanguard) |

| Growth Portfolio | U.S. Stock Fund (Vanguard) |

| International Stock Fund (BlackRock) |

| Predesigned Portfolios: |

| Conservative Portfolio |

| Moderate Portfolio |

| Growth Portfolio |

| Fund Options: |

| Money Market (Florida PRIME) |

| U.S. Bond Fund (Vanguard) |

| U.S. Stock Fund (Vanguard) |

| International Stock Fund (BlackRock) |

Free to enroll. No monthly maintenance fee with eDelivery.