FAQs

Have questions?

The answers below might help.

Have questions?

The answers below might help.

Prepaid Card

General

How It Works

Benefits

Qualified Expenses

Eligibility

Opening an Account

Gifting

Tax Benefits

ABLE United is the state of Florida’s ABLE program and is administered by Florida ABLE, Inc., a direct-support organization of the Florida Prepaid College Board. ABLE United offers ABLE accounts in accordance with Section 529A of the Internal Revenue Code. This account is a unique investment and savings tool designed to help Floridians with eligible disabilities save for qualified expenses. Individuals can invest for the future in this tax-advantaged account without impacting resource limits of federal benefits (like SSI, SSDI, Medicaid, SNAP, TANF, HUD Assistance, Section 8, etc.).

Vestwell State Savings, LLC (d/b/a Sumday Administration) is the plan manager for ABLE United and provides the online platform for the ABLE United account. For more information, check out the Program Description & Participation Agreement.

The Stephen Beck, Jr., Achieving a Better Life Experience (ABLE) Act, a federal law enacted in December 2014, authorizes each state to establish a program that offers tax-free savings and investment options to encourage individuals with a disability and their families to save private funds to support health, independence and quality of life. In July 2015, the state of Florida created Florida ABLE, Inc., to administer Florida’s ABLE Program, ABLE United.

Money contributed to an ABLE account is generally disregarded when determining eligibility for federal benefit programs, such as Supplemental Security Income (SSI) and Medicaid.

The individual with a disability (“Beneficiary”) must be a Florida resident at the time of application and have a qualifying disability with onset prior to age 26 (age change coming soon). If the Beneficiary is able and chooses to exercise signature authority over the account, they are also the Administrator.

If the Beneficiary is under 18 or is unable, or chooses not, to exercise signature authority over the account, then “Administrator” refers to an Authorized Legal Representative (“ALR”).

An ALR is a Custodian for the Beneficiary, such as an individual selected by the Beneficiary, or the eligible individual’s agent under a power of attorney, conservator or legal guardian, the spouse, a parent, a sibling, a grandparent, or a representative payee (whether an individual or organization) appointed by the Social Security Administration (SSA), in that order. It is noted that the representative payee is subject to all applicable SSA rules. The ALR may neither have, nor acquire, any beneficial interest in the account during the Beneficiary’s lifetime and must administer the account for the benefit of the Beneficiary. Learn more about the ALR role.

Please note, a Beneficiary can only have one ABLE account at a time.

Generally, an ABLE account does not replace a Third-Party Special Needs Trust (“SNT”), but rather works in conjunction with an SNT. An SNT can be used to fund an ABLE account, can encompass non-cash assets, requires an attorney to set up, and can be costly. ABLE accounts are flexible, grow tax-free, and are low-cost to maintain.

For more information, visit our ABLE accounts and SNT’s webinar.

Please consult a lawyer if you have additional questions.

No. ABLE United accounts are protected from bankruptcy.

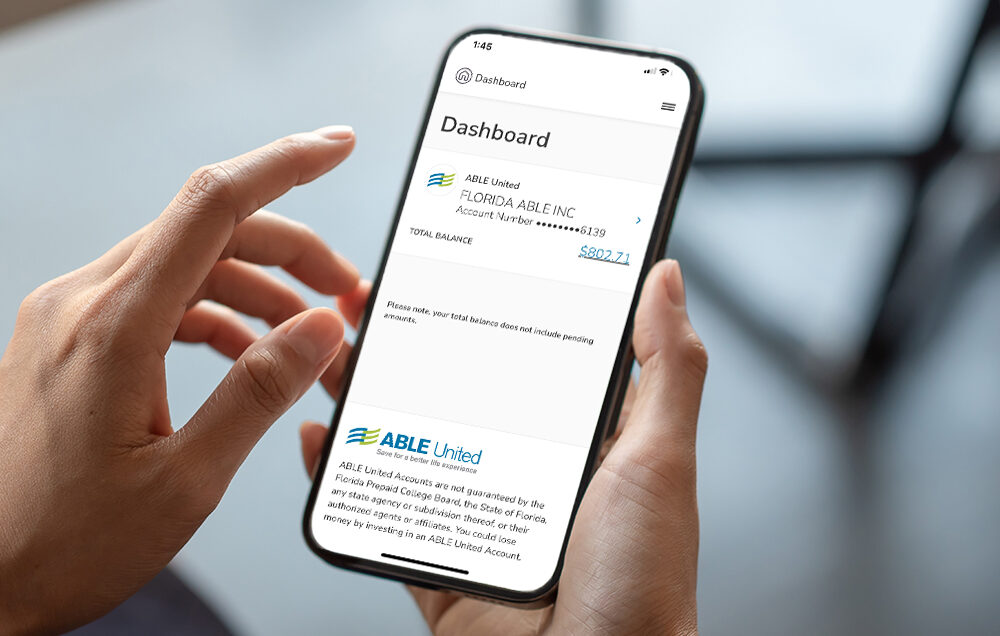

Yes, monthly transfers are a great way to help an ABLE United account grow and reach your yearly goal. Direct deposits, also known as monthly transfers, are automatic contributions that you can set up in just a few steps directly from your account. Look for the “Transfers” tab near the top once you’re signed in and follow the instructions.

Yes, however the easiest and fastest way to enroll and manage an ABLE United account is online. If you want to use paper forms for enrollment or managing your account, you can find them on the Forms & Publications page.

Yes, we’ve made it easy by allowing you to securely log in and connect a bank account or multiple bank accounts. To connect, log in to your ABLE United account, go to the “Settings” tab located in the top right and click on the “Add a new bank” tab. Follow the steps by connecting your bank account via Plaid, a third-party application that verifies your account information, or by manually adding your bank account and routing number. If you manually add a bank account, you will need to upload a voided check or statement.

Keep in mind, new bank accounts added manually will have a 10-day withdrawal hold period; however, those added via Plaid will only have a 5-day withdrawal hold period.

Once you’re logged into your ABLE United account, go to the “Settings” tab and find the “Add a new bank” button. Follow the steps to connect a new bank account associated with either the Beneficiary of the ABLE United account or the Authorized Legal Representative. Keep in mind that you won’t be able to withdraw money from an ABLE United account to a newly added bank account for 10 days, so that we can verify the information you gave us.

You can connect a checking or savings account to your ABLE United account. These types of accounts use Automated Clearing House (ACH) payments, which are a fast and efficient way to make electronic payments.

Each Beneficiary can only have one ABLE account open at a time. If you currently have an ABLE account with another state, it can be rolled over to Florida’s program, ABLE United, by using the ABLE to ABLE Rollover Form.

If you are an Authorized Legal Representative of one or multiple Beneficiaries, you can manage multiple accounts. See how to open additional ABLE United accounts.

If you’re an Authorized Legal Representative of more than one Beneficiary, you can open an account for a new Beneficiary from the account you currently administer in a few steps. Once you’re signed into ABLE United, look for the “Add an account” link in the upper right corner of the screen, or in the navigation on your mobile device. Click it and follow the steps to create a new account for a new Beneficiary.

Please note, a Beneficiary can only have one ABLE account at a time.

Yes. If you’re an Authorized Legal Representative of more than one Beneficiary (or yourself and a Beneficiary), you will have one username (email) and password to log in to all of the ABLE United accounts you manage.

No. You can’t transfer funds from one account to another account. You can, however, roll over funds in an ABLE account to a member of the family.

Each ABLE United account is treated separately, and each will receive separate tax documents. Please consult your tax adviser for information about whether you need to file taxes for an account. At the end of each year, you will receive a 5498-QA showing contributions and the establishment of the account. If a withdrawal was made from the account, you will receive a 1099-QA showing the earnings and basis of the distributions.

In the event of the death of a Beneficiary, the ABLE United account is payable to the estate of the deceased designated Beneficiary; however, funds from the account can be used to pay any outstanding Qualified Disability Expenses, including funeral and burial costs.

The Beneficiary may list a successor designated beneficiary before their death. However, before any transfer to the successor designated beneficiary, the account is subject to the federal estate tax imposed by chapter 11 of the U.S. Code upon the estate of the deceased Beneficiary, as well as payment of any outstanding Qualified Disability Expenses, and any state claim under section 529A(f).

If a Beneficiary has passed away and the personal representative/executor of their estate is not the Authorized Legal Representative, the executor may submit a death certificate and a certification that they are the personal representative and responsible for the proper disposition for the account balance. The personal representative may complete a Death of Beneficiary Form to have the remaining balance sent to the Beneficiary’s estate.

The Florida Medicaid program may not file a claim for Medicaid recovery of funds in an ABLE United account. Upon the death of a designated Beneficiary, funds in the account can be used to pay for outstanding Qualified Disability Expenses, including funeral and burial.

The Beneficiary may list a successor designated beneficiary before their death. However, before any transfer to the successor designated beneficiary, the account is subject to the federal estate tax imposed by chapter 11 of the U.S. Code upon the estate of the deceased Beneficiary, as well as payment of any outstanding Qualified Disability Expenses, and any state claim under section 529A(f).

Federal law requires that each state recover Medicaid expenditures from a Medicaid recipient’s estate, however there are exceptions. For example, the Medicaid recipient must have been age 55 or older. If the beneficiary received Medicaid in another state, please check the law of that state, as federal law also allows a state to file a claim for Medicaid expenditures from an ABLE account.

For more information on Medicaid estate recovery, visit Florida’s Medicaid Estate Recovery Program here. If a Beneficiary has passed away, the executor of his or her estate should complete a Death of Beneficiary Form.

Generally, money in an account is not considered an asset for state and federal benefits purposes. However, Beneficiaries receiving Supplemental Security Income (SSI) can only have up to $100,000 in the account before the funds start to count against the $2,000 asset limit.

To keep the ABLE United account safe, don’t share your password or let someone else have access to your account.

If you want to add, change or remove the Authorized Legal Representative for the account, contact customer service Monday – Friday, 9am – 6pm ET at 1-888-524-2253, or Florida Relay Service dial 711.

Simply give us a call, and we’ll help you out. Reach us Monday – Friday, 9am – 6pm ET at 1-888-524-2253. We’ll be sad to see you go.

To reopen a closed account, please call customer service.

You can make withdrawals of at least $5 from your account online at any time. The money will be transferred to your bank account* or loaded to your ABLE Visa prepaid card in 2 – 7 business days, depending on how the money is allocated.

If you want to withdraw more than $25,000, or you don’t have an online account, you can request a Withdrawal Form by contacting customer service.

A check request can be made by using the Withdrawal Form. If your request is received in good order, the check should arrive by mail within 5 – 7 business days.

If you request a full withdrawal, your balance will be $0, and the account will remain open until the end of the calendar year. After that, an account with no balance may be closed by calling customer service.

Please note that contributions made by the Authorized Legal Representative or Beneficiary within the past 5 business days or gift contributions received within the past 10 business days will not be available for withdrawal.

* Bank accounts that have been connected to an ABLE United account within the past 10 calendar days cannot be used for withdrawals.

Once your bank is connected, you can make contributions of at least $5 directly into your ABLE United account at any time online. It’s easy and secure. You can also set up recurring monthly contributions of $5 or more.

Checks are also welcome if accompanied by a Contribution Form.

Make your check payable to ABLE United and mail it with the Contribution Form to:

ABLE United Program

P.O. Box 534422

Pittsburgh, PA 15253-4422

Keep in mind that there is a 5-business-day hold period on the amount of check contributions before those funds can be withdrawn.

Yes. For new contributions, you may select which Investment Options to contribute to.

For money that is already in an ABLE United account, the allocation of the account balance may be modified up to two times per calendar year.

Money saved in the FDIC Savings Option is insured for amounts up to $250,000 by the Federal Deposit Insurance Corporation (FDIC) and could earn minimal interest. The interest will fluctuate slightly based on the interest rate of the U.S. capital markets.

ABLE United offers seven professionally managed investment options designed to meet the needs of most investors. These include predesigned portfolios and individual funds from which a custom portfolio may be built by allocating funds to one or more options.

The performance of your investment will vary from day to day based on the performance of the underlying stock, bond and money market securities. The investment when withdrawn may be worth more or less than contributions.

Also, withdrawals can take 2 – 7 business days to complete, depending on how the money is allocated. Learn more about the Investment Options or visit Investment Performance for more information on past performance.

The FDIC Savings Option is an alternative to investing. Assets up to $250,000 are protected and insured by the Federal Deposit Insurance Corporation (FDIC). Keep in mind that with a low level of risk, there’s also a lower level of returns. For more information on the savings and investment options, visit Investment Options.

Yes, but under IRS requirements, you are only allowed to change your invested funds allocation two times each year. You can change how new contributions are allocated at any time.

Any changes to invested funds will be applied to prior contributions and earnings. If you do make a change to your investment option, we’ll sell your units in the original option and use the proceeds to buy units in the new one. You can make a change online from your account or contact customer service for an Investment Option or Allocation Change Form.

You can decide to invest your money in a predesigned portfolio (Conservative, Moderate or Growth) or you can build your own with any combination of predesigned portfolios, a money market fund, U.S. or international stock funds, U.S. bond fund, or the FDIC savings fund.

How you decide to invest your money is up to you, but you should consider your risk tolerance and savings goal.

To learn more about each portfolio, visit Investment Options or talk to your financial adviser.

In order to establish an account, a selection of an investment and/or saving option(s), a minimum contribution of at least $25 must be made. After that, you can add as little as $5 at any time.

Don’t forget: You’ll need bank login information, or account and routing numbers, to set up your online ABLE United account.

To open an account with a paper check, please use a paper Enrollment Form.

Friends, family and organizations can make contributions to your account to help you reach your savings goals. You can share a link to your Gifting Page or download the Gift Form to allow people to contribute directly to your account.

Gift contributions count toward your yearly contribution limit. So, if you’ve already reached the limit, your page will remain public, but no one can contribute again until next year.

Annual Standard Contribution Limit

There’s a $19,000 yearly limit for standard contributions — this includes any gift contributions made to your account. Remember, there is a $5 contribution minimum.

ABLE to Work Contribution Limit

With ABLE to Work, if a Beneficiary is earning wages from employment, they can contribute an amount equal to the Beneficiary’s current year gross income up to $15,060 (for 2025) each year, in addition to the yearly contribution limit of $19,000.

If the Beneficiary or their employer is contributing to a defined contribution plan (i.e., 401(k)), annuity plan (403(b)), or deferred compensation plan (457(b)) this calendar year, the Beneficiary is not eligible to make ABLE to Work contributions.

Maximum Balance

There is a maximum balance of $500,000 for each account. Once your account reaches this limit, your account may continue to earn money, but you will not be able to make any additional contributions until your balance dips below this limit.

No. Having an ABLE United account doesn’t count towards your eligibility for Medicaid, regardless of the amount saved in the account.

If withdrawals from the account for the calendar year exceed the Qualified Disability Expenses, the individual may be subject to income tax, plus an additional 10% penalty. Consult a tax professional for additional guidance.

A withdrawal used for a non-eligible expense could affect your eligibility for SSI benefits, Medicaid or other means-tested benefits under federal or state programs. A withdrawal that is applied to a housing expense in any month after the month of the withdrawal could impact SSI benefits.

Keep your receipts and documentation for all eligible expenses in case the IRS wants to see them or, if receiving SSI, the Social Security Administration. We don’t need proof of your expenses, but you should have it for your records.

If you sign up for an ABLE Prepaid Card, you can review and manage your card activity from your online account. This will help keep track of your purchases, but you should still save your receipts.

Yes, you can use money from an account for housing expenses. If you’re receiving SSI, the money must be used within the month it was withdrawn so it does not affect your SSI eligibility.

If the money in an ABLE United account is spent on one of the following Qualified Disability Expenses, as defined by federal law, the earnings on the money withdrawn are tax-free. Some of these expenses include: health, education, housing, transportation, legal fees, financial management, employment training and support, assistive technology and personal support services, oversight and monitoring, funeral and burial, and other expenses approved by Treasury regulations.

Qualified Disability Expenses include basic living expenses and are not limited to items for which there is a medical necessity or which solely benefit the Beneficiary.

As long as the expense relates to the Beneficiary and helps maintain or improve their health, independence, or quality of life, it can be considered a Qualified Disability Expense. Please read the Program Description & Participation Agreement for more information on Qualified Disability Expenses.

If asked by the IRS or Social Security Administration, for those receiving SSI, the Beneficiary or Authorized Legal Representative is responsible for providing receipts for Qualified Disability Expenses.

You can withdraw money from your account for any reason. If it’s used for Qualified Disability Expenses, there is no tax on the earnings portion of the withdrawal. See the list of approved categories of Qualified Disability Expenses for more details.

You can also sign up for an ABLE prepaid card, load money from an ABLE United account and use it online or in stores all over the U.S.

No. You can keep your federal and state benefits (SSI, SSDI, Medicaid, SNAP, TANF, HUD Assistance, Section 8, etc.) with an account. If you receive SSI, there is a $100,000 limit before funds start counting against your $2,000 asset limit. As long as the money withdrawn is used for eligible expenses, it won’t count toward the limit.

Housing expenses are not a countable resource for SSI if they are paid directly from the account to a third party or withdrawn and paid in the same month. Withdrawals retained for Qualified Disability Expenses, other than housing, are not a countable resource for SSI. These funds must remain unspent and identifiable and are excluded in the months leading up to the actual expenditure.

One of the main benefits of having an ABLE United account is being able to save for Qualified Disability Expenses and invest for the future in a tax-advantaged account. Earnings on the account grow tax free as long as the funds are used for Qualified Disability Expenses.

Generally, funds in (or withdrawn from) an account are disregarded when determining Supplemental Security Income (SSI), Medicaid eligibility and other resource means-tested public benefit programs (SNAP, TANF, HUD Assistance, Section 8, etc.). For more information on having an account and public benefits, click here.

Other benefits include the option to have a prepaid card to use for qualified expenses, and the ability to have family and friends contribute to your account.

There is no account maintenance fee. It is free to request a withdrawal via ACH or a check. If you choose to opt out of electronic statements, there is a $10 per year fee for paper statements.

There is a small investment fee that ranges between 0 and 29 bps (from $0 to $2.90 per year per $1,000 in the account). Additional fees may be assessed based on how you use the account.

If you choose to sign up for a prepaid card, there will be a $2.50 per month fee. Additional prepaid card fees may be assessed based on how you use your prepaid card.

Please see the Program Description & Participation Agreement for more information about fees.

As long as the disability or blindness developed before the age of 26, there are no age restrictions. There are newborns who have an account, as well as individuals in their 80s.

If a Beneficiary is under the age of 18, they must have an Authorized Legal Representative (“ALR”) do it for them. An ALR is a Custodian for the Beneficiary, such as an individual selected by the Beneficiary, or the eligible individual’s agent under a power of attorney, conservator or legal guardian, the spouse, a parent, a sibling, a grandparent, or a representative payee (whether an individual or organization) appointed by the Social Security Administration (SSA), in that order. Learn more about the role of an ALR.

If you’re the Beneficiary of the account, make sure you have this information handy:

If you’re an Authorized Legal Representative, you’ll need your information (email, date of birth, Social Security Number or Tax Identification Number, contact details and work status). You’ll also need to know the Beneficiary’s eligibility information.

If the Beneficiary is not eligible for SSI or SSDI benefits, they need a signed Diagnosis Form from a licensed physician. You won’t need to provide it for registration, but the IRS or the Program may ask for it at any time.

An Authorized Legal Representative (“ALR”) is someone who is legally authorized to make decisions for the Beneficiary as it relates to their ABLE account. An ALR is a Custodian for the Beneficiary, such as an individual selected by the Beneficiary, or the eligible individual’s agent under a power of attorney, conservator or legal guardian, the spouse, a parent, a sibling, a grandparent, or a representative payee (whether an individual or organization) appointed by the Social Security Administration (SSA), in that order. The ALR may neither have, nor acquire, any beneficial interest in the account during the Beneficiary’s lifetime and must administer the account for the benefit of the Beneficiary.

If you are interested in a power of attorney for a Beneficiary, you can find one specific to ABLE United here.

Yes. Contributions into an ABLE United account from wages still count as earned income, but do not count as an asset for federally means-tested programs such as Medicaid. For SSI, the first $100,000 does not count as an asset.

Beneficiaries who work can contribute more than $19,000 per year. To learn more visit ABLE to Work.

There can only be one ALR per account, but you may change an ALR by submitting a request. You may request a Change of Authorized Legal Representative Form by contacting customer service Monday – Friday, 9am – 5pm ET at 1-888-524-2253, or Florida Relay Service dial 711.

The account and the funds in it are owned by the Beneficiary, regardless of whether they opened the account or if it is managed by an Authorized Legal Representative.

Yes, but you can only make one rollover every 12 months. You should use the other ABLE plan’s rollover form to start the process.

Yes, this would be considered a rollover. You can only make one rollover every 12 months. Use the ABLE to ABLE Rollover Form to get started. There are also rollover options for eligible family members if the rollover happens before the death of the original Beneficiary who opened the account.

The Beneficiary has to be a Florida resident at the time of application to be eligible for an account. If the Beneficiary moves out of the state, they can continue to utilize the ABLE United account!

We encourage those who move out of state to learn more about that state’s ABLE plan, as there might be state-specific benefits. To learn more about other ABLE programs, visit the ABLE National Resource Center.

An individual meets the disability and severity criteria to open an ABLE account if at least one of the following is true:

Those who don’t receive Social Security benefits are still eligible if they can get a signed Diagnosis Form from a licensed physician.

Any disability that qualifies for SSI or SSDI or blindness that developed before the age of 26 is eligible for an ABLE account (age change coming soon).

The Internal Revenue Service categorizes eligible disabilities as follows:

Those who don’t receive social security benefits are still eligible if they can get a signed Diagnosis Form from a licensed physician.

You can check eligibility by using our simple Eligibility Wizard.

The ABLE to Work Act allows Beneficiaries who are employed to contribute an amount equal to their current year gross income up to $15,060 each year to their ABLE account in addition to the annual standard contribution limit.

You can make an ABLE to Work contribution online or by using the Contribution Form.

Keep in mind that if the Beneficiary or their employer is contributing to a defined contribution plan (such as a 401(k)), annuity plan (403(b)), or deferred compensation plan (457(b)) this calendar year, the Beneficiary is not eligible to make ABLE to Work contributions.

Here is a link to the rules and guidelines you should know about.

Yes, you can roll over money from a 529 College Savings account into a Beneficiary’s (or family member’s*) ABLE United account without being penalized.

These types of rollovers count toward the $19,000 maximum annual contribution limit.

You can use a 529 College Savings to ABLE United Direct Rollover Form if the movement of funds is coordinated by the 529 College Savings Plan Manager and ABLE United.

You can use a 529 College Savings to ABLE United Indirect Rollover Form if the funds have been withdrawn from the 529 College Savings Plan.

*The family member must be considered a qualified “Member of the Family” as defined by the 529 College Savings Plan, which includes: biological and step-parents; aunts; uncles; siblings; children; first cousins; nieces and nephews; parents, siblings, children, nieces and nephews by marriage; legally adopted children; and half-brothers or half-sisters) of the 529 College Savings account Beneficiary.

Anyone who has a link to your gifting page can contribute toward your goal. You can also give friends and family a Gift Form if they’d like to mail a check contribution.

Keep in mind that gift contributions count toward your annual contribution limit. So, if you’ve already reached it, your page will remain public, but no one can contribute again until next year.

If you decide to show your gifting limit, your gifting page will display the percentage of your goal that you’ve reached so far, so people who visit your page can see your progress.

Don’t worry, they can’t see the actual dollar amount you’ve collected or how much you want to save.

No problem. You can delete the gifting page anytime you want, and the contributions that have previously been gifted (including pending contributions) will stay in your account.

To delete your page:

Once you’ve deleted your gifting page, you’ll be able to set up a gifting page again in the future if you want.

Once your gifting page has been deleted, you’ll still be able to receive gift contributions by check, as long as you have not reached your annual contribution limit.

Making an online ACH (bank) contribution is free, as is mailing in the Gift Form and paper check.

When a gift contribution has processed, you’ll get an email letting you know someone contributed to your account. All processed gift contributions will also appear in your activity feed. Please keep in mind, any gift contributions made through an online gifting page will not be available for withdrawal for 10 business days.

To contribute online, first make sure the recipient has set up their gifting page. Then use their gifting page link to fill out the form fields as directed — like your name, address, the amount you want to contribute, whether you want to pay by debit card or with a bank account, and the occasion for your generosity.

The funds are not taxable if used for Qualified Disability Expenses. If withdrawals from the ABLE account for the calendar year exceed the Qualified Disability Expenses, the earnings portion of the funds may be subject to income tax, plus a 10% penalty. Consult a tax professional for additional guidance.

Keep in mind that these funds may be considered an asset for federal means-tested programs, like Supplemental Security Income or Medicaid. Alternatively, you may roll over the funds to another ABLE account.

The Beneficiary of an ABLE account is not affected when the ALR passes away because the Beneficiary owns the account. To change or remove the ALR, contact customer service Monday – Friday, 9am – 5pm ET, at 1-888-524-2253, or Florida Relay Service dial 711.

The True Link ABLE Visa Prepaid Card is a reloadable Visa card that is connected to your ABLE United account. You can load money to your card using any of the savings or investment options in which you have a balance. The card can be used everywhere Visa debit cards are accepted. Since it is not a credit card, there is no credit check to obtain the ABLE Visa Prepaid Card.

An ABLE Visa Prepaid Card can be issued for the Beneficiary and/or Authorized Legal Representative. You can track your expenses online through True Link Financial, Inc. There is a $2.50 monthly fee associated with the card for ABLE United participants. This fee will be automatically debited from the card on a monthly basis. Additional terms and conditions do apply; please see the Cardholder Agreement.

For more information, visit the prepaid card page. You can enroll here or sign in to your Visa Prepaid Card account here.

To sign up for an ABLE Visa Prepaid Card, you must have a valid ABLE United account. Request a card by logging into your account and clicking the “Sign Up For a Prepaid Card” box in the lower right-hand corner of the Overview page, or by clicking here.

You can load money to your ABLE Visa Prepaid Card from your ABLE United account. You may not add funds to your card account from other sources such as credit cards, debit cards, other bank accounts, cash, or by sending personal checks, cashier’s checks, retailer load networks (e.g., Green-Dot, MoneyGram, Western Union, etc.) or money orders.

The ABLE Visa Prepaid Card can be reloaded automatically each month by using the “Manage Monthly Withdrawal” form. Complete Step 5 with your TrueLink account and routing number. Alternatively, you may call customer service to establish these instructions.

A maximum of 95% of your available ABLE account balance can be transferred and loaded onto your ABLE Visa Prepaid Card, subject to the daily and monthly load card maximums. See your Cardholder Agreement for any additional limitations.

You can track your transaction activity and card balance via the TrueLink website. If your ABLE Visa Prepaid Card account has a zero or negative balance for 4+ consecutive months, TrueLink may automatically close your card account without advance notice.

The ABLE Visa Prepaid Card can be used everywhere Visa debit cards are accepted, online and in stores.

You may not use your ABLE Visa Prepaid Card for online gambling or illegal transactions. Please see the Cardholder Agreement for other limitations. Similarly, the Authorized Legal Representative may put additional limitations on card activity using the True Link system.

If you believe your ABLE Visa Prepaid Card or any other access information has been lost or stolen, immediately call 1-888-219-9054.

If you make a withdrawal from your account, you will receive an IRS Form 1099-QA. This tax form details all withdrawals made throughout the tax year from your account.

Generally, if withdrawals from the account are used for the Beneficiary’s Qualified Disability Expenses, the earnings portion of the withdrawals are not subject to federal income taxation. To discuss your unique situation, please consult a tax adviser.

Learn more about Form 1099-QA from the IRS.

If a contribution is made to your account, you will receive IRS Form 5498-QA. This tax form details all contributions made throughout the tax year to your account, including contributions, rollovers and direct program-to-program transfers.

ABLE United is required to file all account information with the IRS; this is a record of that information.

To discuss your unique situation, please consult a tax adviser.

Learn more about Form 5498-QA from the IRS.

The 1099-QA will be sent via mail or electronic delivery, based on your communications preference, by January 31.

The 5498-QA will be sent via mail or electronic delivery, based on your communications preference, by March 15.

A successor for an ABLE United account must be a sibling, step-sibling or half-sibling of the account Owner and must also qualify for an ABLE United account. A successor must be added to the account before the death of the beneficiary.

A gifting page is automatically created when you establish an account. It is a unique web page that allows family, friends, organizations and others to easily make contributions directly to your account online. They can simply go to your unique gifting page URL and add funds to your account.

You can access your gifting page by signing in to your account and looking for the “View gifting page” on your overview page.

You can set a limit on gifts, so you don’t over contribute to your account.

For easier gifting, family and friends can create a gifting profile to save their banking information and have their own personal dashboard with easy access to review their gifting history and receipts.