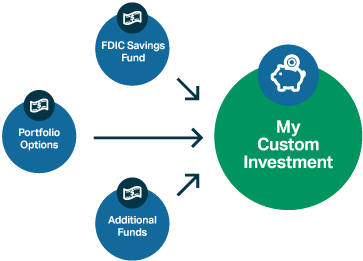

ABLE United offers eight professionally managed investment options designed to meet your unique savings goals. These include professionally designed portfolios with varying risk levels and individual fund options from which a custom portfolio may be built. You can choose one or more options.

These investment options were specifically designed to meet the needs of savers, beginning investors, and those with investment experience. You can choose to select one or more of the eight options each time you contribute to your account, or you can just save in one. In other words, you can build your account your way. Also, earnings in your ABLE United account grow tax-free, so your money works harder for you!

The FDIC Savings Fund is an FDIC-insured savings account option. Funds will be placed in a demand deposit account established by the Trust at the Bank of New York Mellon (Bank). The FDIC Savings Fund is insured by the FDIC on a pass-through basis to each Beneficiary in the same manner as other deposits held by the Beneficiary at BNY Mellon in the same ownership right and capacity. FDIC insurance generally protects up to $250,000 of your deposits, subject to certain restrictions

For more information on FDIC insurance, visit www.fdic.gov.

Annual Fee: 0%

|

||

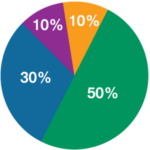

| Money Market Fund | 10% | |

| U.S. Bond Fund | 50% | |

| U.S. Stock Fund | 30% | |

| International Stock Fund | 10% | |

|

||

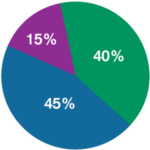

| U.S. Bond Fund | 40% | |

| U.S. Stock Fund | 45% | |

| International Stock Fund | 15% | |

|

||

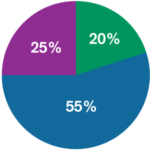

| U.S. Bond Fund | 20% | |

| U.S. Stock Fund | 55% | |

| International Stock Fund | 25% | |

The Money Market Fund is invested in Florida’s Local Government Surplus Funds Trust Fund (Florida PRIME), which invests in short-term, high-quality fixed-income securities rated in the highest short-term rating category to provide stable returns with less risk. The fund seeks to provide, in priority order, safety, liquidity and returns comparable to short-term instruments with minimized risks.

For more information about this option, please visit Florida PRIME’s website.

Annual Fee: 0.035% of Account Balance

The U.S. Bond Fund is invested in the Vanguard Total Bond Market Index Fund Institutional Plus Shares (ticker symbol: VBMPX), a passively managed bond fund which tracks the performance of a benchmark index. Investments include U.S. Treasury and U.S. Government Agency obligations, as well as corporate debt and securitized instruments. The fund seeks to provide investors with exposure to the broad fixed income market in the United States.

For more information about this option, please visit Vanguard’s website.

Annual Fee: 0.290% of Account Balance

The U.S. Stock Fund is invested in the Vanguard Total Market Index Fund Institutional Plus Shares (ticker symbol: VSMPX), a passively managed stock fund which tracks the performance of a benchmark index that measures the investment return of the overall U.S. equities market. The fund seeks to provide investors with exposure to the overall U.S. equities market.

For more information about this option, please visit Vanguard’s website.

Annual Fee: 0.290% of Account Balance

The International Stock Fund is invested in the iShares MSCI EAFE International Index Fund (ticker symbol: BTMKX), a passively managed stock fund which tracks the performance of a benchmark index of international developed markets. The fund seeks to provide investors exposure to international equities in developed markets.

For more information about this option, please visit BlackRock’s website.

Annual Fee: 0.290% of Account Balance

During the online enrollment process, you’ll need to contribute at least $25. Select your investments by entering a dollar amount next to each savings and investment option you want to contribute to. Any future contributions may be made to the original options or you may select from any of the other options. Please note that each fund requires a $5 minimum contribution. If your savings goals change in the future, you can reallocate your invested funds twice per year. So, get started saving and investing in a brighter future with ABLE United!