A recent National Disability Institute study found that only 30% of adults with disabilities and 46% of those without disabilities have set aside three months of emergency funds … money for a rainy day.

If this past year has taught us anything, it is that saving for the unexpected is critically important.

So many people suffered from loss of income and other challenges because of COVID-19. But the disability community is at a disadvantage because many of them are unable to save for emergencies or rely on personal funds for the unexpected “rainy” days.

For so long, many individuals with disabilities receiving public benefits like Social Security or Medicaid were previously only allowed to save $2,000.

These financial constraints inspired a group of parents who have children with disabilities to advocate for the passage of the ABLE Act which led to the creation of ABLE United, Florida’s disability savings program.

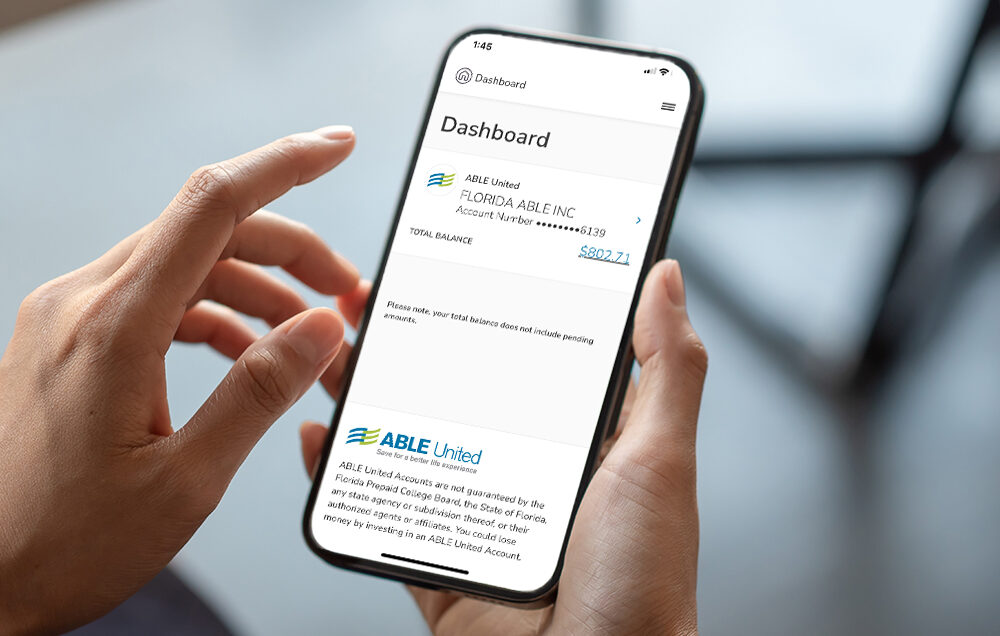

At its core, ABLE United believes that every individual with a disability deserves the opportunity for an independent life – and with these tax-advantaged savings and investment accounts, thousands of Floridians with a disability can now secure their future without impacting their benefits.

Today, we are launching the Rainy Day Campaign.

Now until June 30, when you complete enrollment online and contribute at least $25, you will receive a FREE $50 contribution into your new ABLE account, your own rainy day fund.

Whether you’re a current account holder, or considering trying out an account, we are here for you. Rain – or shine.

*Promotion Guidelines:

Enroll in an ABLE United account between April 1, 2021 and June 30, 2021 on ableunited.com, and you will receive a $50 contribution into your new ABLE United account. This offer only applies to new accounts for beneficiaries who have not had an account with ABLE United previously and are opened between April 1, 2021 and June 30, 2021. Funds earned will be deposited directly into your ABLE United account 6-12 weeks after the promotion ends. ABLE United is a savings and investment plan that may be used to set aside funds for qualified disability expenses. Funds may be used tax-free to pay for any qualified disability expense. This promotion is limited to the first 1,000 accounts. ABLE United reserves the right at its sole discretion to disqualify any individual it finds to be in violation of the guidelines or any laws, or to be attempting to undermine the legitimate operation of the promotion by cheating, hacking, deception, or any other unfair practices. Please review the Program Description and Participation Agreement before opening an account.

Back to Blog

Back to Blog